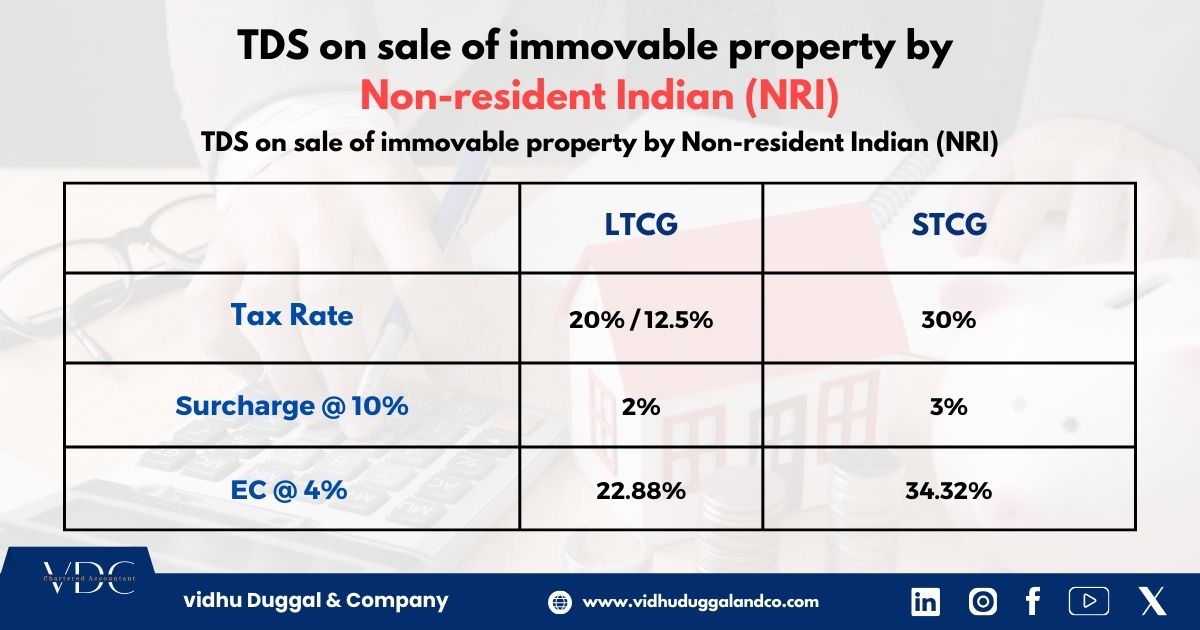

If property is sold after 23.07.2024, NRI can opt for taxation at 12.5% (without indexation benefit) or 20% (with indexation benefit).

🔍 Points to Consider:

1️⃣ If the property is held for more than 24 months, then Long-Term Capital Gain (LTCG) shall be calculated; otherwise, Short-Term Capital Gain (STCG) shall be calculated.

2️⃣ 📝 Form 27Q is required to be submitted by the buyer on deduction & deposit of TDS.

3️⃣ 🆔 The buyer is required to obtain a TAN to file Form 27Q.

#NRI #NRItax #NonResident #IncomeTax #CapitalGain #LTCG #STCG #Property #TDS #RealEstate #Taxation #Finance #GlobalTax #NRIPolicy #TaxCompliance #Investment

2314 Likes