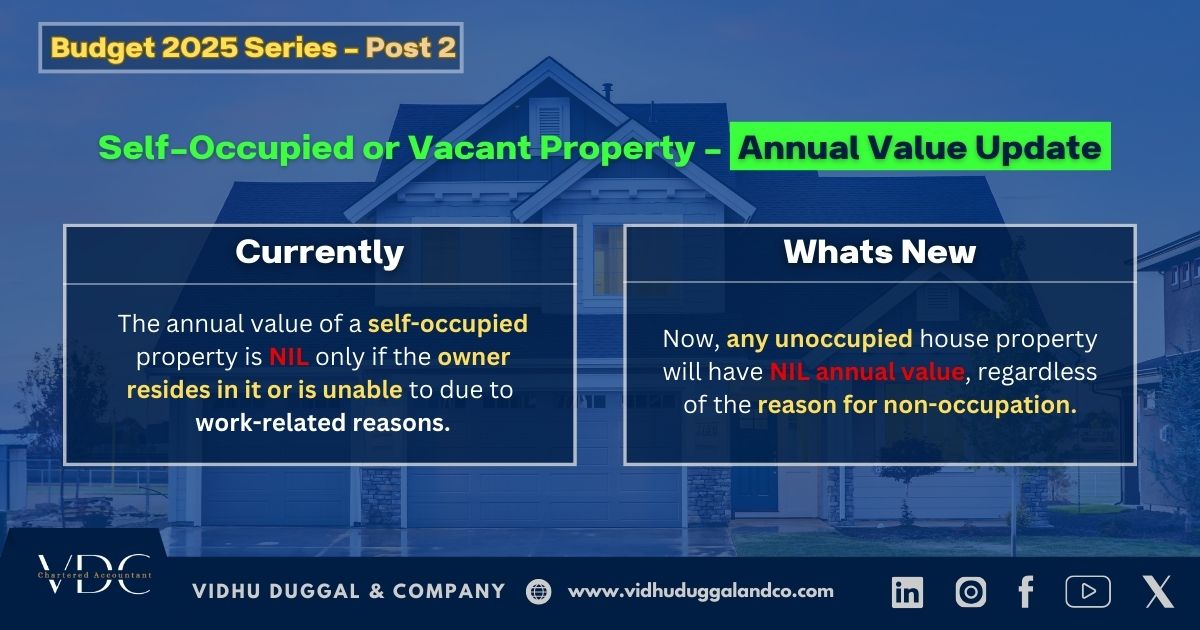

Annual Value of the property self-occupied or vacant

Presently,

annual value of the property shall be taken to be NIL if it is occupied by the owner for his own

residence or if he cannot reside therein due to reasons of his business /

profession / employment.

To relax these restrictions, it is now proposed

that income from a house property would be considered as nil even if the

owner cannot occupy it for any reason.

It has been amended to any reason from the

present conditions of non-occupancy of employment