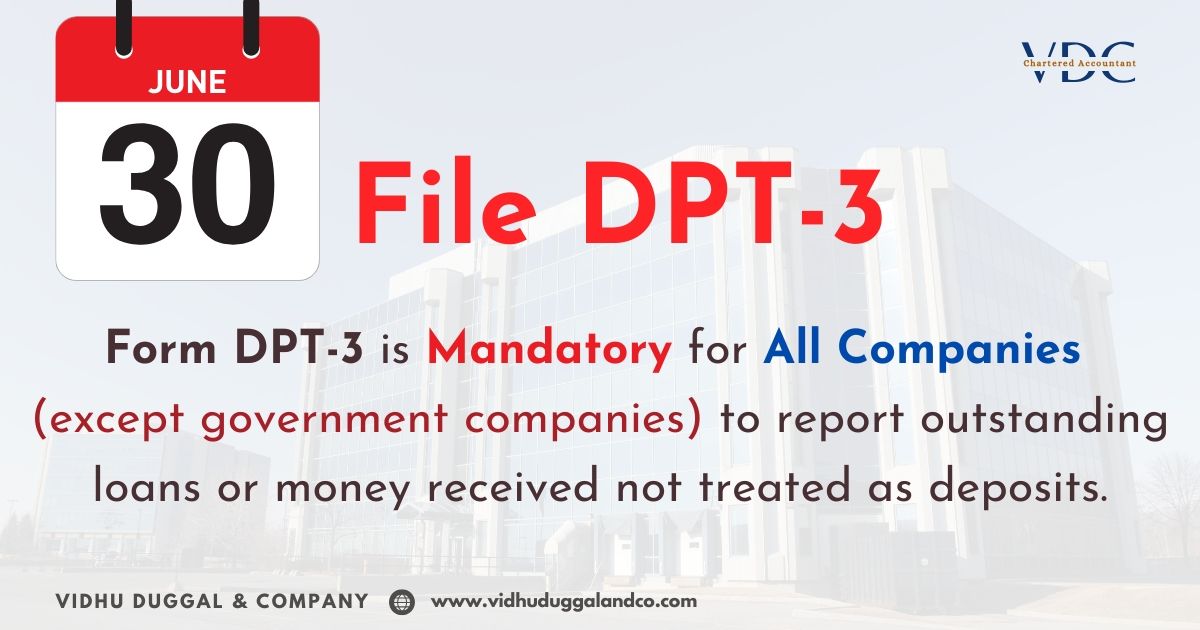

𝐅𝐨𝐫𝐦 𝐃𝐏𝐓-3 is mandatory for all companies (except government companies) to report outstanding loans or money received that is not treated as deposits.

📌 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐅𝐨𝐫𝐦 𝐃𝐏𝐓-3?

It’s a return of deposits that must be filed annually by companies to report money received from:

✔️ Directors

✔️ Shareholders

✔️ Inter-corporate loans

✔️ Related parties

✔️ Unsecured loans

✔️ Advances not considered deposits under 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐀𝐜𝐭

📅 𝐃𝐮𝐞 𝐃𝐚𝐭𝐞 𝐟𝐨𝐫 𝐅𝐘 2024–25:

✅ 30𝐭𝐡 𝐉𝐮𝐧𝐞 2025

⚠️ Non-filing can lead to penalties under Section 76A of the Companies Act.

💡 𝑷𝒓𝒐 𝑻𝒊𝒑: Even if your company has not accepted any deposits, DPT-3 may still be applicable if you’ve received loans or advances.

📍 𝐃𝐏𝐓-3 𝐢𝐬 𝐍𝐎𝐓 𝐨𝐩𝐭𝐢𝐨𝐧𝐚𝐥 — 𝐢𝐭’𝐬 𝐚𝐧 𝐚𝐧𝐧𝐮𝐚𝐥 𝐑𝐎𝐂 𝐜𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞.

𝑨𝒗𝒐𝒊𝒅 𝒍𝒂𝒔𝒕-𝒎𝒊𝒏𝒖𝒕𝒆 𝒔𝒕𝒓𝒆𝒔𝒔 𝒂𝒏𝒅 𝒑𝒆𝒏𝒂𝒍𝒕𝒊𝒆𝒔.