About Us

Vidhu Duggal & Company (VDC) is a Delhi-based Chartered Accountancy firm driven by a team of skilled and forward-thinking professionals. With a strong foundation of experienced Chartered Accountants, we offer end-to-end financial and regulatory services under one roof.

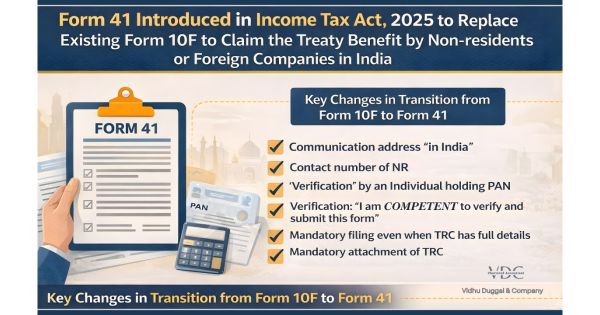

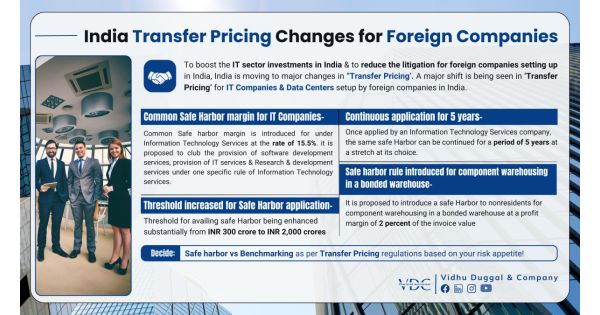

As a dynamic and growth-oriented firm, we deliver high-quality expertise across accounting & auditing, income tax, GST, company law, FEMA, international taxation, transfer pricing, import–export, startup advisory, NGO compliances, and a wide spectrum of financial and business services.

Our commitment goes beyond compliance—we focus on building a workplace that inspires excellence, collaboration, and innovation. With every passing year, we continue to strengthen our capabilities and create an environment where our team and clients grow together.

Explore More