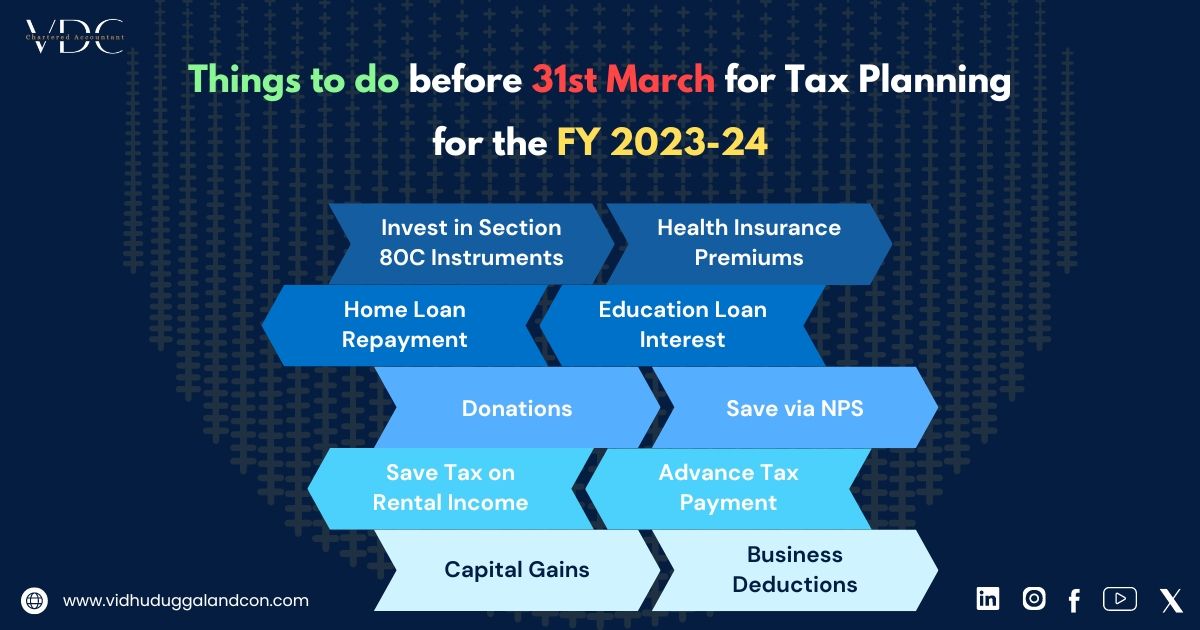

Before the financial year ends on March 31st, there are several things you can do to save on taxes in India. Here's a checklist of strategies and investments to consider:

1. Invest in Section 80C Instruments :

- Public Provident Fund (PPF): A long-term investment option with tax-free returns.

- Equity-Linked Savings Scheme (ELSS): Offers growth potential along with tax benefits.

- National Pension System (NPS): Contributes to retirement savings and offers an additional tax deduction of up to Rs. 50,000 under Section 80CCD(1B), over and above the Rs. 1.5 lakh limit under Section 80C.

- Fixed Deposits (FDs): 5-year tax-saving fixed deposits.

- Life Insurance Premiums

- National Savings Certificate (NSC): A fixed income investment scheme.

- Senior Citizens’ Saving Scheme (SCSS): For those aged 60 years or above.

- Sukanya Samriddhi Yojana (SSY): For the girl child’s education and marriage expenses.

2. Health Insurance Premiums :

- Under Section 80D, claim a deduction for health insurance premiums paid for yourself, spouse, children, and parents. The limit is up to Rs. 25,000 for yourself and family and an additional Rs. 25,000 for parents (Rs. 50,000 if parents are senior citizens).

3. Home Loan Repayment :

- The principal amount repaid on a home loan is eligible for deduction under Section 80C.

- Interest payment on home loans for a self-occupied property can claim a deduction up to Rs. 2 lakh under Section 24.

4. Education Loan Interest :

- Interest paid on education loans for higher studies can be claimed as a deduction under Section 80E, with no upper limit.

5. Donations :

- Contributions to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G.

6. Save via NPS :

- Apart from the Rs. 50,000 deduction under Section 80CCD(1B), employee contributions to NPS (up to 10% of salary) can be deducted under Section 80CCD(1), within the overall limit of Rs. 1.5 lakh under Section 80C.

7. Save Tax on Rental Income :

- If you have rental income, you can claim a 30% standard deduction for repairs and maintenance, regardless of the actual expenditure.

8. Advance Tax Payment :

- Ensure all your advance tax payments are done to avoid interest under Sections 234B and 234C.

9. Capital Gains :

- If you have any long-term capital gains, consider investing them in specified assets to avail exemption under Section 54 to Section 54F.

10. Business Deductions :

- For professionals or business owners, make sure you deduct all eligible business expenses before March 31st.

Planning and Documentation

- Collect Documents: Keep all investment proofs, loan statements, insurance premium receipts, and tuition fees receipts handy.

- Tax Planning for Next Year: Start planning for the next financial year to spread out investments and not rush at the last minute.

Implementing these strategies before March 31st can help you optimize your tax savings for the financial year.

753 Likes